Introduction

As an insurance lawyer, my working day revolves around damages: how much, to whom, and for what. We argue over loss of earnings, cost of care, special damages, general damages. We measure, calculate, dispute, and settle. It is an elaborate system – but, at its core, still about money as compensation.

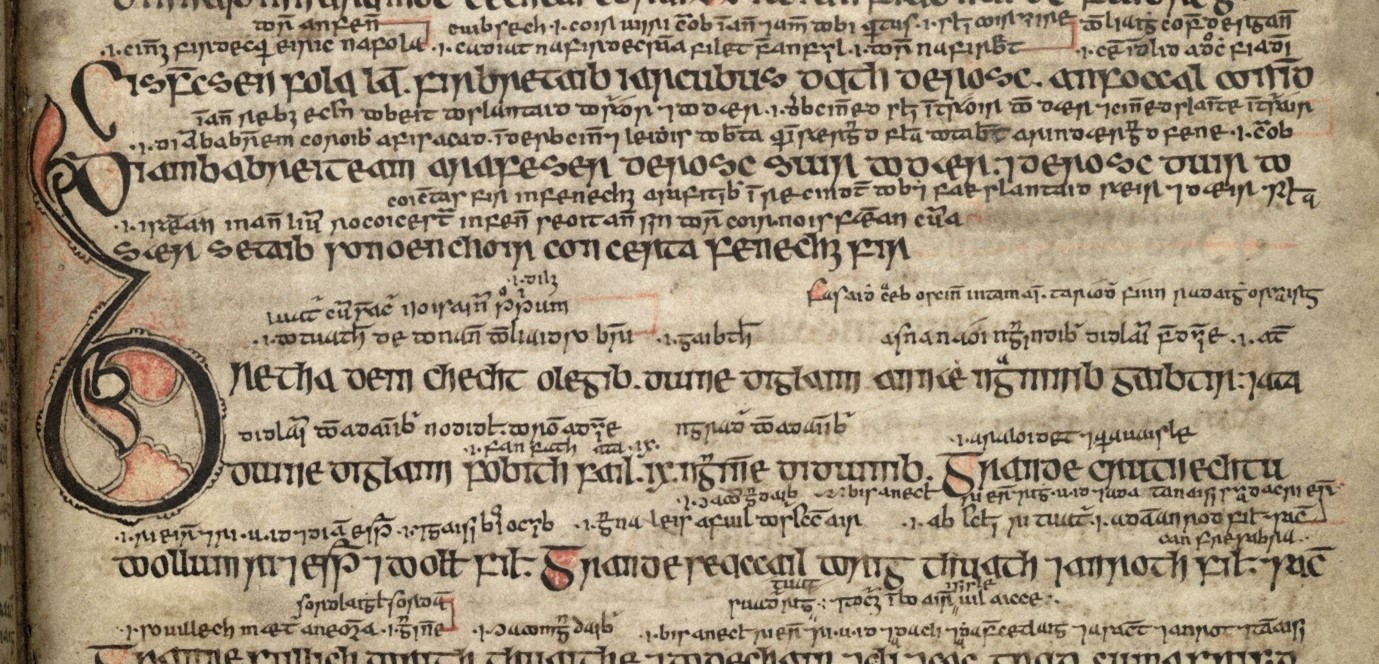

Law and its Prominence in Early Gaelic Literature

Recently, I have been studying early Gaelic (Irish) literature and the importance of Irish law. Law is so central in early Irish literature because it was closely linked to how society explained and maintained itself. The jurists (brithemain) belonged to the same learned class as poets and historians, and their work was preserved as senchas – tradition – rather than as abstract statutes. This is why the great collection Senchas Már lies at the core of the legal corpus: it is presented not just as law but as a narrative, connecting rules to origin legends and the authority of saints and kings. Within it, texts like Bretha Crólige (“Judgements on Sick-Maintenance”) demonstrate how vividly law could respond to real-life situations, detailing the obligations owed to a wounded person. Together, they show why law dominates early Irish writing: it was both the backbone of social order and a vital part of cultural memory, recorded in the same literary medium as history, poetry, and saga.

Binchy and Bretha Crólige

D. A. Binchy’s edition of Bretha Crólige, the Old Irish tract on “blood-lying” (sick-maintenance- or othrus) is worth analysis, in the modern context. Binchy’s central observation is simple but striking. While compensation tariffs for injury are broadly Indo-European, the Irish obsession with the day-to-day maintenance of the injured person is unique in its detail.

Tariffs Across Europe

Most early medieval legal systems, from the Salic Law to the Welsh Laws of Hywel Dda, worked from tariffs: so many shillings for an eye, so many for a tooth, a sliding scale for fingers and toes. The idea was familiar: money smooths over disruption.

The Irish texts contain these tariffs too – tables of éraic (compensation) for wounds and insults, carefully graded by rank. In that sense, Ireland sits squarely in the European mainstream.

The Irish Twist: Crólige as Obligation

But Bretha Crólige adds a twist. As Binchy notes:

“The most striking feature of Bretha Crólige is its detailed regulation of sick-maintenance: the obligation imposed on the injurer to feed and tend the wounded man until recovery.”

Here, damages aren’t just a payout. They become an obligation to care: housing the victim, feeding him, paying for his doctor, maintaining his household. The wrongdoer is bound, day after day, into the life of the person he injured.

The tract even specifies food schedules and arrangements for substitutes. Where our modern system trusts a lump sum to cover uncertainty, the Irish law, first demanded continuous support until recovery.

What Struck Me as a Modern Lawyer

Coming to this with my insurance-law lens, I couldn’t help mapping Bretha Crólige onto today’s compensation landscape: Whilst there was no award for pain and suffering, there was an emergence of various heads of damages.

- Loss of earnings? Covered, because the wrongdoer sustains both victim and dependants.

- Special damages for care? Built in: the wrongdoer must provide the care directly.

- Future uncertainty? Managed, because the obligation continues until the end of illness (or life).

The justice was far from egalitarian—rank dictated quality of care—but the concept is profoundly restorative rather than purely monetary.

Why It Matters

Bretha Crólige raised a challenge that hasn’t gone away. Modern tort law prizes once-and-for-all damages, tidy settlements. Yet whenever we deal with long-term care claims, periodic payment orders, or disputes over statutory benefits, I find myself wondering whether the old Irish lawyers had a point: sometimes justice looks less like a cheque and more like an obligation to keep showing up.

Conclusion

Bretha Crólige showed us a legal system that refused to reduce injury entirely to money. It tied wrongdoer to victim in an ongoing relationship of care. It was an example of an approach focused on the victim, rather than the wrongdoer or the society that condoned the wrongdoer. Not that it was universal, however. In his introduction to A Guide to Early Irish Law, Fergus Kelly notes that another text, Críth Gablath, stated that the institution of orthus or sick maintenance was obsolete and had been replaced by payment of appropriate fines. Perhaps an early example of a change in the law, moving away from a restorative based approach, as Kelly suggested one of the possible reasons (he offers several) for the variation, being differences in dates between the texts.