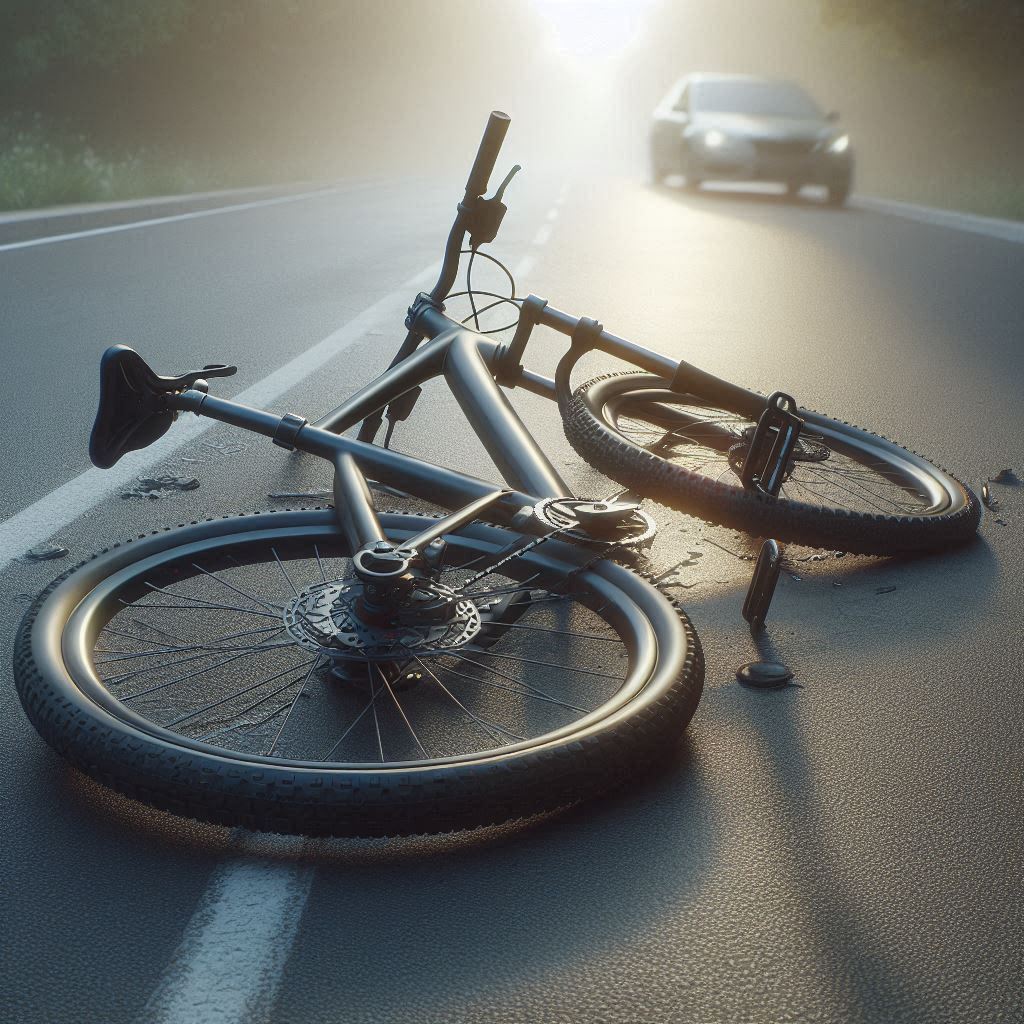

As the weather improves, more cyclists take to the roads across Northern Ireland, especially in cities like Belfast. Unfortunately, the warmer months also bring a significant rise in cycling accidents. If you or a loved one has been involved in a bicycle accident, it’s important to know your rights and how to pursue a personal injury claim.

Recent statistics show a worrying increase in cycling-related injuries across Northern Ireland, with numbers returning to pre-pandemic levels by 2023. Despite the growing popularity of cycling for commuting and recreation, local roads remain among the most dangerous for vulnerable road users like cyclists and pedestrians.

Unlike drivers, cyclists lack proper physical protection. As a result, they are more likely to suffer serious injuries in the event of a road traffic accident.

At Lacey Solicitors, our experienced cycling accident solicitors in Belfast are here to help you seek the compensation you deserve.

Common Causes of Cycling Accidents in Belfast and NI

Cycling accidents in Northern Ireland can occur in various circumstances—during daily commutes, weekend rides, or even organised cycling events. Some of the most common accidents that we see arise from:

- Car door collisions – when a driver opens their door without checking for oncoming cyclists

- Overtaking accidents – where a vehicle passes too closely

- Careless or distracted driving form other road users

- Animals straying onto the road

If you’ve been injured due to any of the above, you may be entitled to compensation for your cycling accident.

Common Types of Cycling Accident Injury

Cyclists often sustain serious and long-lasting injuries when involved in road accidents. Some of the most common injuries include:

- Traumatic brain injuries (TBI)

- Spinal cord injuries

- Facial injuries and dental trauma

- Broken bones and dislocations

- Road rash and severe abrasions

- Soft tissue injuries

- Amputations

In addition to physical trauma, many cyclists also suffer from psychological injuries such as PTSD, anxiety, or depression following a crash. At Lacey Solicitors, we understand the full scope of these injuries and can help you claim compensation for both physical and emotional suffering.

You can learn more about bringing a claim for compensation for psychological trauma courtesy of Lacey Solicitors Firm.

Eligibility to Make a Personal Injury Compensation Claim After an Accident

If you were injured in an accident on your bicycle and it was not your fault, then you may be eligible. You can also claim compensation after a bike accident for a family member either due to their inability to do so due to injuries, their lack of mental capacity, or if they are a minor.

Is there a time limit on making a claim after a cycling accident in NI?

In Northern Ireland, you typically have three years from the date of your accident to begin legal proceedings. For minors, the three-year time limit starts from their 18th birthday.

Don’t delay—early legal advice can make a big difference in the success of your claim.

What is the Process for Making a Cycling Accident Injury Claim in Northern Ireland?

If you’ve been injured in a cycling accident, the first step is to contact Lacey Solicitors. We’ll arrange a consultation and begin gathering the necessary details to support your case.

You’ll likely need a medical assessment to confirm the extent of your injuries. From there, we’ll handle all legal aspects of the process, including:

- Collecting evidence

- Communicating with insurers

- Negotiating a fair settlement

Our goal is to secure the maximum compensation available for your injury and loss.

How Much Could a Compensation Claim for a Cycling Injury in NI be Worth?

The value of your claim depends on several factors, including:

- The severity of your injuries

- The impact on your daily life and work

- Medical expenses and ongoing care costs

- Loss of earnings

- Pain and suffering (physical and emotional)

While every case is unique, Lacey Solicitors previously secured €580,000 in compensation for a client who suffered life-changing leg injuries in a cycling incident. We will ensure you receive the compensation you rightfully deserve.

Contact Lacey Solicitors – Belfast’s Trusted Cycling Injury Lawyers

If you’ve been injured in a cycling accident anywhere in Ireland or Northern Ireland, Lacey Solicitors Dublin & Belfast is here to help. Our dedicated team of personal injury lawyers has the experience and local knowledge needed to handle your claim with care and expertise.

Let us help you get the justice—and compensation—you deserve.